We believe the production of low impact, sustainable energy isn’t simply a good idea, it’s good business.

As part of an industry that plays a significant role in transitioning to a sustainable future, we are passionately dedicated to making advancements in the production of sustainable energy and being a force for good in our society. Our mission is to lead the energy industry toward the safe and profitable production of net-zero natural gas.

See how we got here

Sustainable, profitable, net-zero natural gas by 2030

See where we’re going

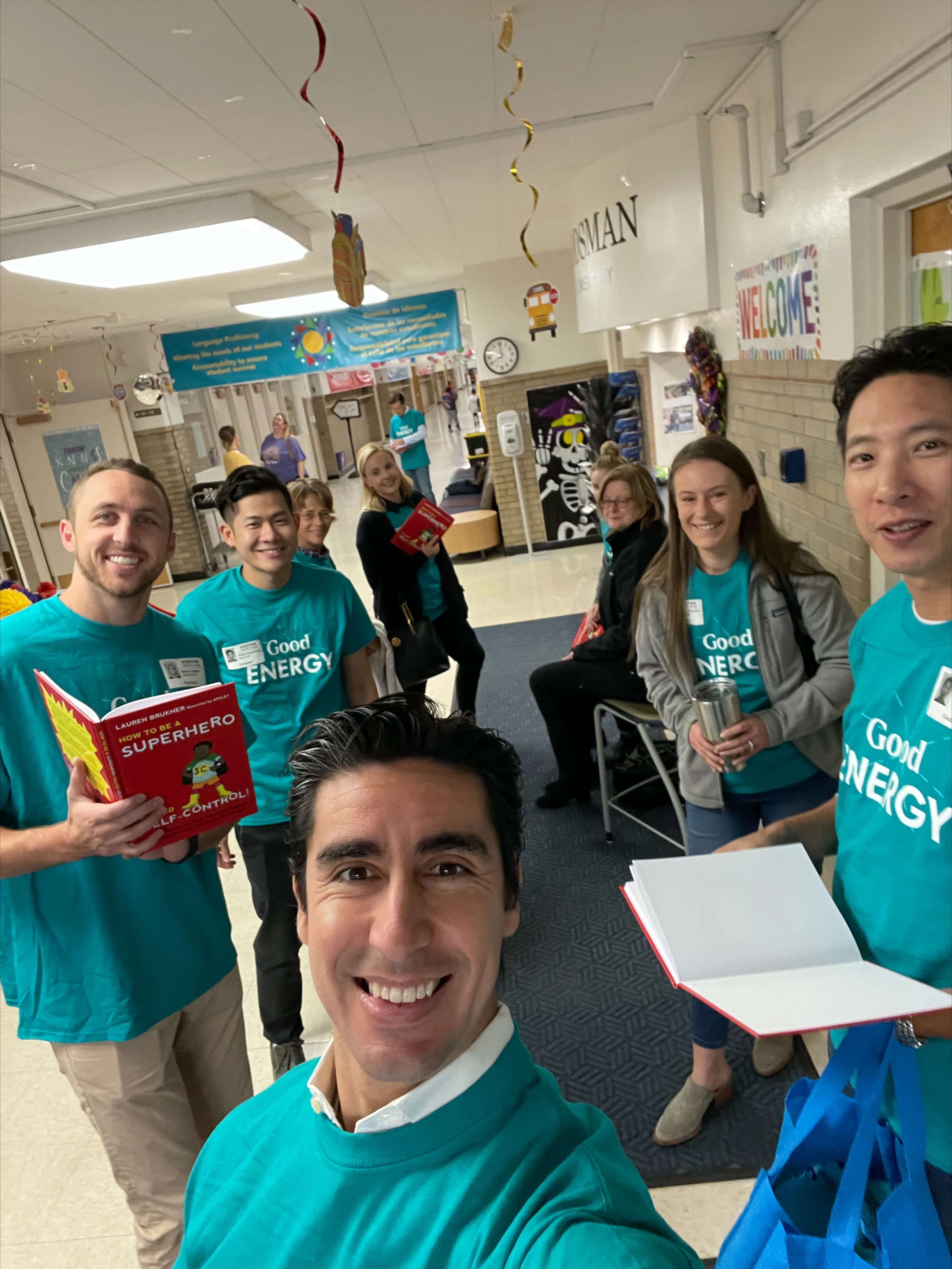

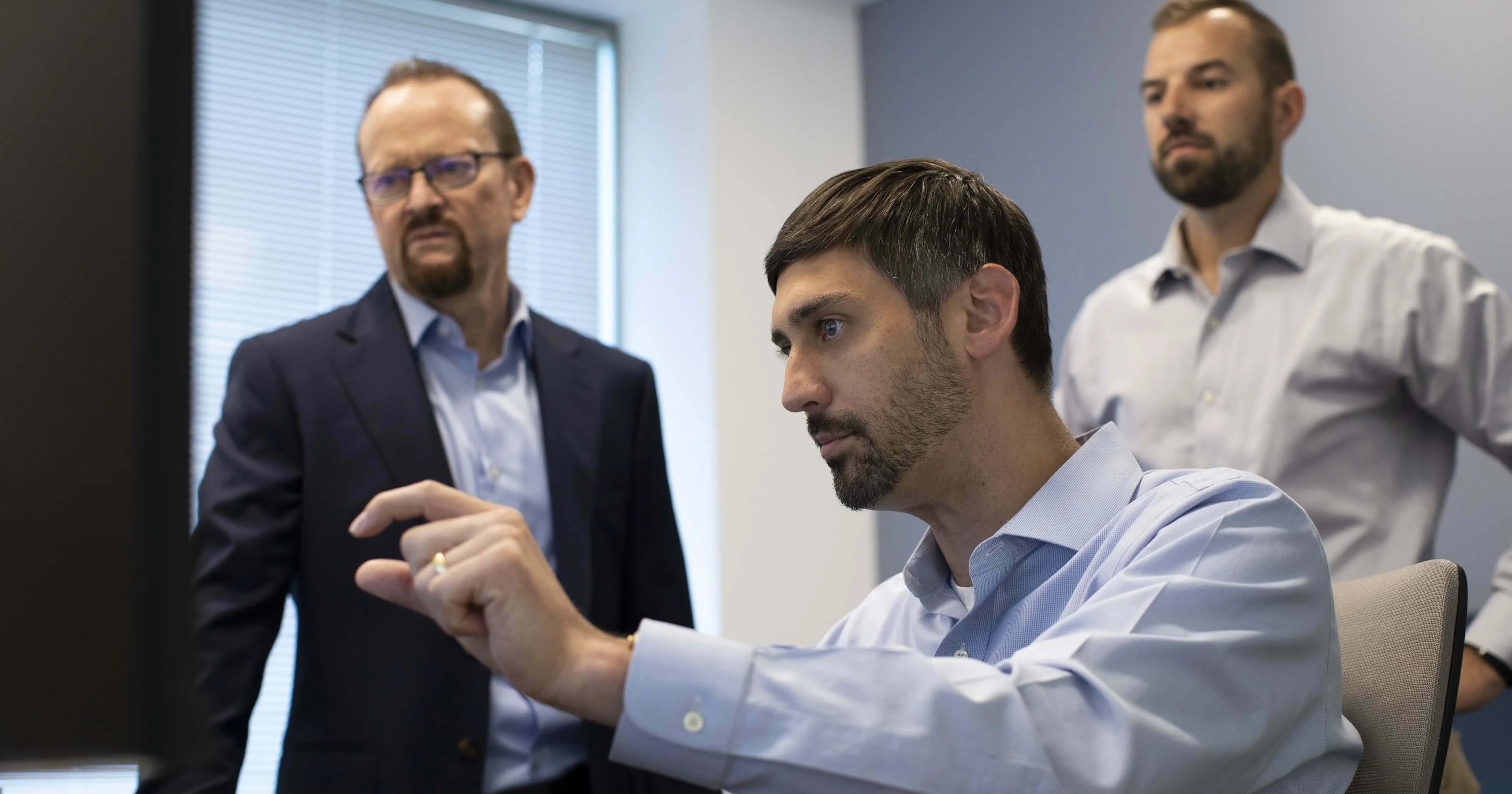

Our People Are Passionate. Innovative. Committed.

Meet our leadership team

Community Engagement